Investment Accounts vs Tax Credits: Key Differences and Benefits for Arab American Families

A clear explanation of how long-term investment accounts differ from immediate tax credits and how Arab families can benefit.

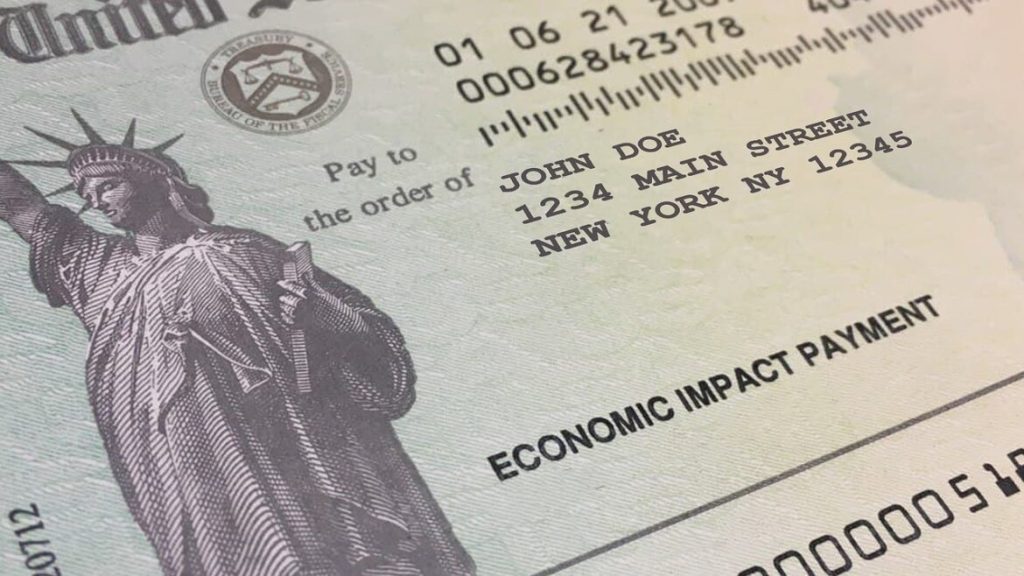

Amid the accelerating economic moves of the new administration, the attention of American families—and Arab families in particular—is turning to two financial packages aimed at easing the cost of living and securing the future. While some people confuse direct cash support with long-term investment, this explanation clarifies the fundamental difference between the “$1,000 for newborns” initiative and the upcoming amendments to the Child Tax Credit.

First: “Trump Accounts”… An Investment in the Next Generation

The decision that recently sparked controversy regarding the “$1,000 grant” is not a check paid out immediately, but rather a step toward strengthening a culture of savings under what is being called “Trump Accounts.”

Beneficiaries: Newborns who hold U.S. citizenship and children born between January 1, 2025, and December 31, 2028.

How it works: The government deposits $1,000 as seed capital into an investment account for each child. Families may add annual tax-free contributions of up to $5,000.

Goal: To take advantage of compound interest to build wealth that can be accessed when the child turns 18, to fund college education or purchase a first home—something that aligns closely with Arab families’ aspirations to secure their children’s future.

Second: Child Tax Credit (CTC)… Immediate Liquidity

To address the current rise in living costs, Trump and his economic team are pushing to expand the Child Tax Credit.

New proposal: Increase the tax credit from the current $2,000 to approximately $5,000 per child per year.

Effect: This would mean an immediate reduction in tax liability or a higher tax refund at year’s end, providing families with cash flow to cope with inflation.

Opposition: Who and Why?

Despite the appeal of these amounts, the package—nicknamed “One Big Beautiful Bill”—faces two major fronts of opposition in Washington:

1) Budget Hawks (conservative Republicans): They warn that these trillions in spending could widen the budget deficit and reignite inflation, especially if funded solely through tariffs.

2) Democrats and progressives: They argue that the investment accounts are a “trap” that benefits the wealthy, since only affluent families can afford to make the additional $5,000 tax-free contributions, thereby widening future class inequality among children.

Conclusion

For the Arab community, the greatest benefit lies in balancing the use of the Child Tax Credit for current expenses with beginning early investment for newborns—while closely following the legislative battles in Congress in the coming weeks.