Federal Reserve Cuts Interest Rates in 2025 Amid Inflation and Employment Concerns

FOMC reduces benchmark rate to 4–4.25%, balancing labor market support with ongoing inflation pressures.

The Federal Reserve announced on Wednesday its first interest rate cut of 2025, as the Federal Open Market Committee (FOMC) reduced the benchmark rate by 25 basis points, bringing it to a new range of 4% to 4.25%.

This decision follows five consecutive meetings in which the Fed kept rates unchanged, amid growing concerns about a slowing labor market and persistent inflation pressures.

During his press conference, Fed Chair Jerome Powell noted that “downside risks to employment have increased,” emphasizing that inflation remains above the 2% target despite easing from its mid-2022 peak. He highlighted that price increases linked to tariffs continue to pose challenges, contributing roughly 0.3–0.4 percentage points to the core Personal Consumption Expenditures (PCE) inflation, which stood at 2.9%.

Powell Highlights Fed’s Commitment to Curb Persistent Inflation

Powell stressed that the central bank cannot assume these price increases are temporary, saying: “Our job is to ensure they do not become persistent inflation.” He noted that the pass-through of costs to consumers has been slower than expected but is gradually appearing in price data.

The decision was supported by 11 of 12 committee members, while new Fed Governor Jeffrey Miran voted for a larger 50 basis point cut in his first vote after replacing resigned Governor Adriana Kugler.

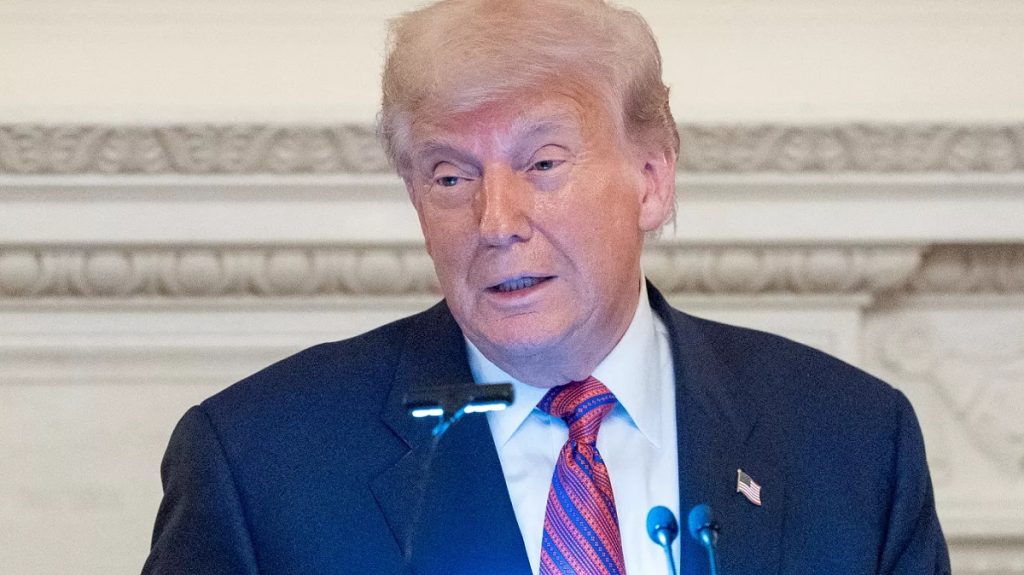

Regarding the Fed’s independence, Powell emphasized that the institution relies solely on data, denying any political influence on its decisions, despite repeated pressure from former President Donald Trump, who had threatened to remove him before backing down.

Powell’s Term, Fed Independence, and the 2025 Rate Cut

CNBC reported that Powell’s term as Fed Chair will officially end in May 2026, but he declined to comment on his future beyond that date. He also avoided commenting on Trump’s attempt to remove Fed Governor Lisa Cook, who faces unproven real estate fraud allegations, though a federal appeals court temporarily blocked her removal and allowed her participation in this week’s meeting.

This rate cut represents a significant shift in monetary policy, reflecting a delicate balance between supporting the labor market and controlling inflation, amid economic data influenced by complex trade and geopolitical factors.