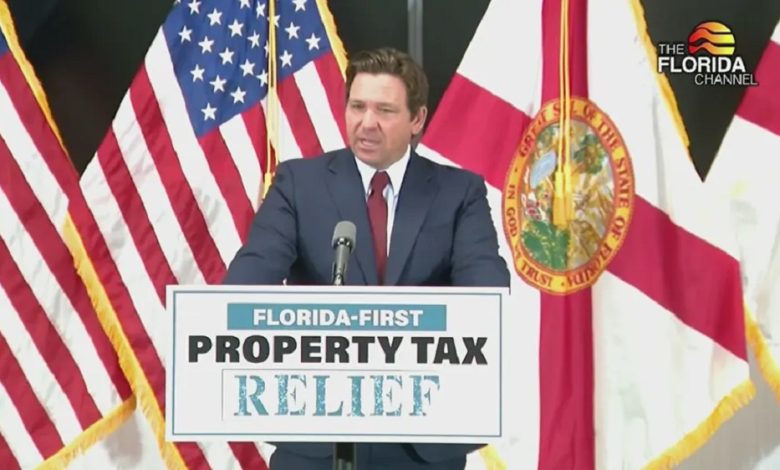

Florida’s DeSantis Pushes Plan to Eliminate Property Taxes on Primary Homes

New proposal aims to make Florida the first state to abolish property taxes—while raising major questions about revenue, schools, and future tax hikes.

Florida Governor Ron DeSantis has unveiled new details about his plan to eliminate property taxes on primary residences, a move he described as necessary to ease the economic pressures facing residents. In an interview with Fox Business, he said: “Local property taxes are hurting people… governments have spent too much, and people are paying more and more because of that.”

The Republican governor confirmed that the ultimate goal is to abolish property taxes “entirely,” which would make Florida the first state in the country to eliminate these taxes on primary homes while remaining an income-tax-free state. But DeSantis clarified that implementation will be gradual and will require approval from 60% of voters in a statewide referendum in 2026.

Lawmakers in the Florida House of Representatives are discussing a package of proposals that includes a $500,000 exemption for primary residences, a potential cap of up to $1 million for seniors, a limit on assessment increases, and a complete option to abolish property taxes.

According to the Florida Policy Institute (FPI), property taxes generate around $55 billion annually, accounting for nearly 18% of county revenues, 17% of municipal revenues, and up to 60% of school funding in some areas. The institute warns that eliminating these taxes could put significant pressure on other revenue sources, with some estimates suggesting the sales tax may need to be raised from 6% to 12%.

DeSantis emphasized that most property-tax revenue comes from non-Florida residents, including second-home owners and commercial properties, representing about 30% of total revenues. He added that revenues increased from $32 billion in 2019 to more than $55 billion today, driven by rising property values after the COVID-19 pandemic, giving the state more resilience during financial crises.

The governor said: “How do you buy a home for $350,000, and then four years later you’re told it’s worth $1 million and that you have to pay a higher property tax? That’s not fair.”