Federal Reserve Poised for September Rate Cut Amid Inflation and Weak Job Growth

Nearly 100% chance of interest rate reduction as U.S. Treasury hints at possible half-point cut

The likelihood of the Federal Reserve cutting interest rates in September is now close to 100% after new data showed that U.S. inflation rose at a moderate pace in July.

Treasury Secretary Scott Bessent stated that a sharp half-percentage-point cut is possible in light of the recent weak employment figures.

In an interview with Bloomberg Television, Bessent said:“If we had seen these numbers in May and June, we might have had rate cuts during those months. This means there is a very high probability of a 50-basis-point rate cut.”

He added: “Interest rates are highly restrictive… perhaps we should lower them by between 150 and 175 basis points.” This reflects the Trump administration’s tendency to exert pressure and publicly criticize the independent central bank.

A Near Certainty

According to Reuters, traders in contracts tied to the Federal Reserve’s benchmark interest rate on Wednesday priced in a 99.9% chance of a quarter-point rate cut at the Fed’s September 16–17 meeting.

This projection came from CME Group’s FedWatch tool following Tuesday’s release of the July Consumer Price Index (CPI) data, along with Bessent’s comments suggesting that the Fed used concerns over a weakening labor market as justification for a larger rate cut in September.

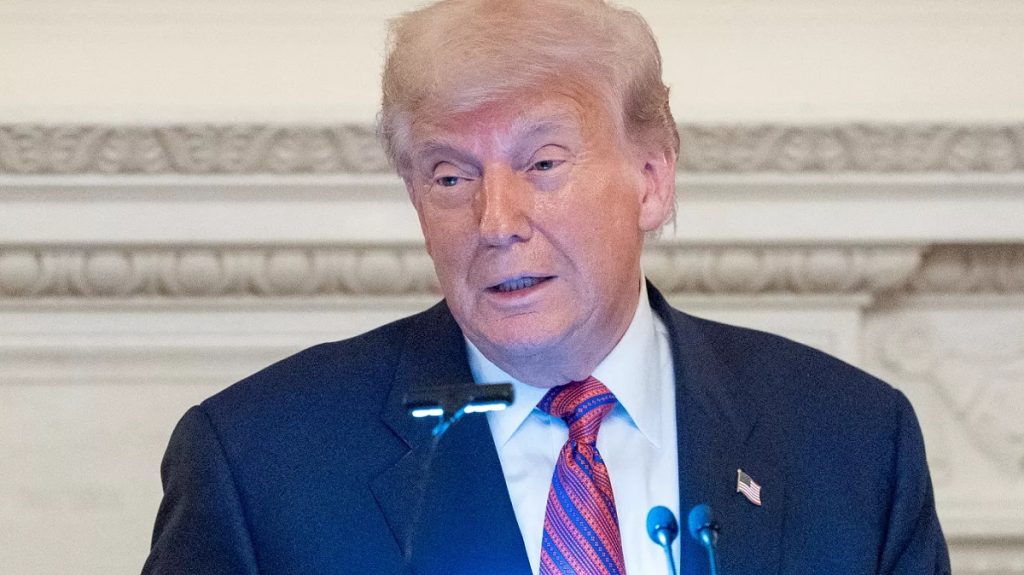

Former President Donald Trump criticized last year’s rate cuts as politically motivated due to their proximity to the November presidential elections. The Fed cut interest rates in three meetings at the end of 2024 — in September and in two meetings after the elections in November and December — and the cuts have been on hold since then.

Powell’s Speech

Fed Chair Jerome Powell is expected to speak next week at the central banking research conference in Wyoming — the same forum he used last year to signal upcoming rate cuts, pled