White House Says Americans Could Get $1,000 More in Tax Refunds in 2026

Trump’s “Big, Beautiful Law” fuels political debate as Republicans hail historic refunds and Democrats question cost-of-living impact.

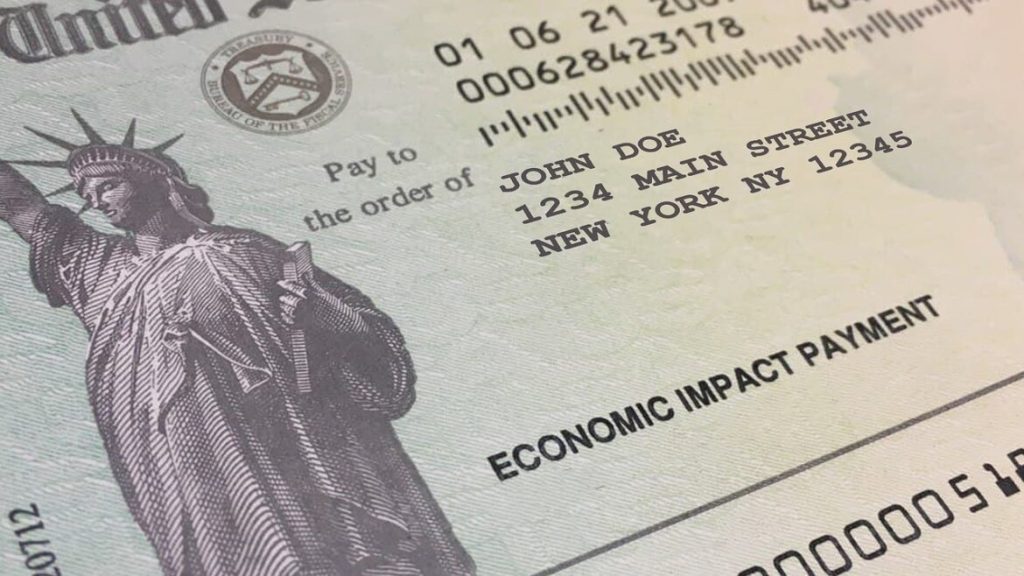

The White House announced that American taxpayers are expected to receive an average additional tax refund of about $1,000 during the upcoming tax season—one of the most prominent outcomes of the “Big, Beautiful Law” signed by President Donald Trump in July.

According to USA Today, White House Press Secretary Karoline Leavitt said during a press briefing that tax refunds for 2026 are “expected to be the largest in history,” emphasizing that the additional funds will boost household income early next year.

Leavitt explained that refunds could be roughly one-third higher than usual—about $1,000 more per taxpayer—based on an analysis by investment bank Piper Sandler. Treasury Secretary Scott Bessent also stated that working families could receive between $1,000 and $2,000 as a result of the new tax cuts.

The law includes retroactive tax relief and eliminates federal taxes on tips, overtime pay, and Social Security benefits. Trump has also recently floated the idea of abolishing federal taxes on gambling winnings. The White House described the upcoming filing period as “the biggest tax refund season in American history.”

However, ABC News reported that these promises have sparked intense political debate. Democrats criticized the measures, arguing they fail to address the rising cost of living. Colorado Governor Jared Polis said his state permanently cut income taxes three times—unlike what he described as Trump’s temporary tax cuts—and highlighted Colorado’s generous child tax credits and anti-poverty efforts. Democratic Representative Brendan Boyle labeled Trump’s promises a “scam,” arguing that the former president’s tariff policies raise prices and deprive Americans of access to health care.

Republicans, by contrast, praised the legislation. House Speaker Mike Johnson said the payments “will change the lives of America’s children,” noting that most Democrats voted against the bill.

Taxes for the 2026 filing year are due on April 15, 2026, and Americans typically receive refunds within weeks of filing—meaning these additional payments could deliver a significant financial boost to household bank accounts early next year.